Brief overview of Sukanya Samriddhi Yojana (SSY): Introduce Sukanya Samriddhi Yojana, a government savings scheme targeted at ensuring financial security for the girl child. Highlight its significance in financial planning.

Importance of government saving schemes in financial planning: Discuss the general importance of government saving schemes in helping individuals and families secure their financial future.

Historical Background

A. Origins and objectives of Sukanya Samriddhi Yojana: Explore the history of SSY, its origins, and the goals it aims to achieve in promoting financial well-being for girls.

B. Evolution and key milestones: Trace the development of Sukanya Samriddhi Yojana over time, highlighting key milestones and changes in its structure.

Key Features of Sukanya Samriddhi Yojana

A. Eligibility criteria for account opening: Explain who is eligible to open an SSY account, focusing on the criteria individuals must meet.

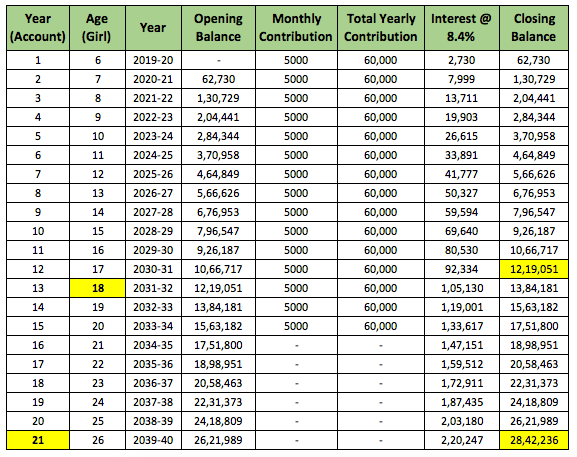

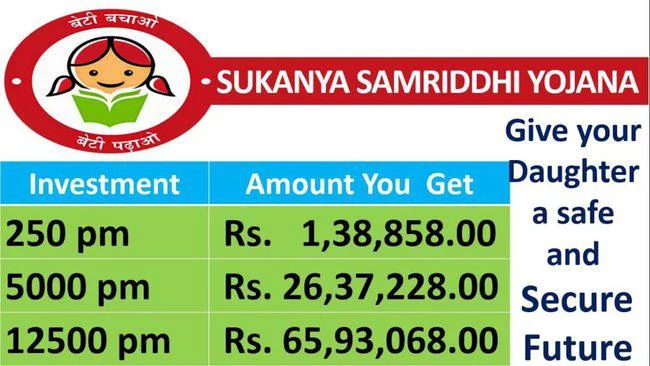

B. Deposit limits and contribution rules: Detail the rules governing the amount of money one can deposit into an SSY account and the associated contribution guidelines.

C. Interest rates and compounding frequency: Discuss the interest rates offered by SSY and how the compounding of interest works over time.

D. Withdrawal conditions and maturity benefits: Explain the conditions under which withdrawals can be made from an SSY account and the benefits that accrue upon maturity.

How to Open a Sukanya Samriddhi Yojana Account

A. Step-by-step guide on the account opening process: Provide a step-by-step explanation of how individuals can go about opening an SSY account.

B. Documentation requirements and eligibility verification: Outline the necessary documents and the verification process required for opening an SSY account.

Comparative Analysis

A. Contrasting Sukanya Samriddhi Yojana with other government saving schemes: Compare SSY with other government saving schemes to help readers understand its unique features.

B. Pros and cons of choosing SSY over alternative options: Highlight the advantages and disadvantages of opting for Sukanya Samriddhi Yojana in comparison to other available choices.

Benefits and Incentives

A. Tax benefits associated with Sukanya Samriddhi Yojana: Explain the tax advantages that come with investing in SSY, emphasizing its potential benefits for taxpayers.

B. Government incentives to promote the scheme: Discuss any additional incentives or support provided by the government to encourage participation in SSY.

Real-Life Success Stories

A. Case studies highlighting positive outcomes from SSY investments: Share real-life examples of individuals or families who have benefited from investing in Sukanya Samriddhi Yojana.

B. Testimonials from beneficiaries: Include testimonials from those who have experienced success with SSY, providing a human perspective on its impact.

Challenges and Criticisms

A. Common challenges faced by Sukanya Samriddhi Yojana investors: Discuss the common difficulties or challenges that investors may encounter when participating in SSY.

B. Criticisms and areas for improvement: Address any criticisms or shortcomings of Sukanya Samriddhi Yojana and suggest potential areas for improvement.

Future Outlook and Potential Reforms

A. Anticipated changes in the Sukanya Samriddhi Yojana: Discuss any expected future developments or reforms in SSY.

B. Government initiatives to enhance the scheme’s effectiveness: Highlight any ongoing or planned government initiatives aimed at improving the overall effectiveness of Sukanya Samriddhi Yojana.

Conclusion

A. Summarizing the key points discussed: Provide a concise summary of the main points covered in the article.

B. Encouraging readers to consider Sukanya Samriddhi Yojana in their financial planning: Conclude by encouraging readers to explore Sukanya Samriddhi Yojana as a viable option in their financial planning endeavors.

APPLY

You can apply for the Sukanya Samriddhi Yojana (SSY) through post offices or authorized bank branches.

One thought on “Understanding Sukanya Samriddhi Yojana as a Government Saving Scheme”