Provide a brief overview of HDFC Bank as one of the leading banking institutions in India.

Highlight the importance of analyzing HDFC Bank Share Prices for investors looking to make informed decisions.

Introduce the purpose of the article: to provide a comprehensive guide on analyzing HDFC Bank’s share price for potential investors.

Understanding HDFC Bank:

- Provide an overview of HDFC Bank’s history, achievements, and market position.

- Discuss the key factors that contribute to the bank’s growth and stability, such as its strong management team, robust risk management practices, and customer-centric approach.

- Highlight HDFC Bank’s financial performance and its impact on share prices, including consistent revenue growth, healthy profitability, and stable asset quality.

Factors Influencing HDFC Bank Share Price:

- Identify and explain the factors that can influence HDFC Bank’s share price.

- Economic factors: Discuss how macroeconomic indicators, such as GDP growth, interest rates, and inflation, can impact the bank’s share price. Explain how a strong economy can lead to increased business opportunities and higher investor confidence.

- Industry-specific factors: Explore trends in the banking industry, regulatory changes, and competitive landscape affecting HDFC Bank. Discuss how factors like changes in government policies, technological advancements, and competition from other banks can impact the bank’s share price.

- Company-specific factors: Analyze HDFC Bank’s financial statements, earnings reports, management decisions, and corporate governance practices. Highlight the importance of evaluating factors such as loan portfolio quality, capital adequacy, cost management, and strategic initiatives.

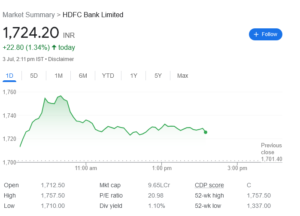

Technical Analysis of HDFC Bank Share Price:

- Explain the concept of technical analysis and its relevance in analyzing share prices.

- Discuss key technical indicators used by investors, such as moving averages, support and resistance levels, and chart patterns. Provide examples of how these indicators can help identify potential entry and exit points for investors.

- Highlight the importance of considering trading volumes and market liquidity when analyzing HDFC Bank’s share price through technical analysis.

Fundamental Analysis of HDFC Bank:

- Introduce fundamental analysis as a method to evaluate a company’s intrinsic value.

- Discuss key financial ratios, such as price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio, and how they can be used to assess HDFC Bank’s financial health. Provide industry benchmarks for comparison.

- Highlight the importance of analyzing HDFC Bank’s business model, competitive advantages, and growth prospects. Discuss factors such as market share, customer loyalty, and expansion plans.

Analyst Recommendations and Market Sentiment:

- Explain the role of analysts’ recommendations and market sentiment in influencing share prices.

- Discuss how investors can interpret analysts’ reports and consensus estimates for HDFC Bank. Highlight the importance of considering different analysts’ opinions and their track records.

- Highlight the significance of market sentiment, investor perception, and news events in shaping HDFC Bank’s share price. Explain how positive or negative news can impact investor confidence and share price movements.

Risk Factors and Mitigation:

Identify and discuss the potential risks associated with investing in HDFC Bank shares.

Market risk: Explain how fluctuations in the broader market can impact HDFC Bank’s share price. Discuss ways to diversify investments and manage portfolio risk.

Regulatory risk: Discuss the regulatory environment in the banking sector and its potential implications for HDFC Bank. Explain how changes in regulations can impact the bank’s operations and share price.

Credit risk: Highlight the importance of monitoring HDFC Bank’s asset quality and loan portfolio. Discuss factors such as non-performing assets (NPAs), provisioning, and risk management practices.

Conclusion:

- Summarize the key points discussed in the article, emphasizing the importance of analyzing HDFC Bank’s share price before making investment decisions.

- Encourage investors to conduct thorough research, seek professional advice, and consider their risk tolerance and investment goals.

- Emphasize the dynamic nature of share prices and the need for continuous monitoring and evaluation.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions.